CONDUCTING “exit interviews” with multinational corporations (MNCs) could help Singapore refine its attractiveness to foreign investment, while funding and tax support could encourage partnerships between MNCs and smaller companies, Members of Parliament (MP) suggested on Wednesday.

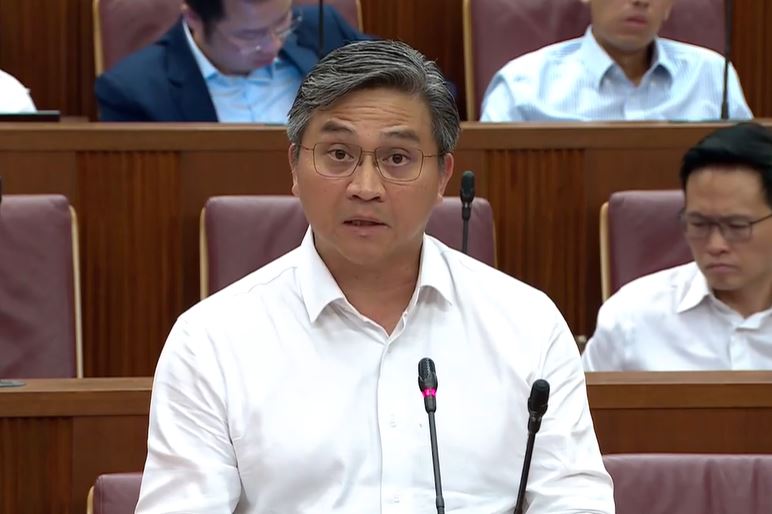

Saktiandi Supaat, MP for Bishan-Toa Payoh GRC, noted that MNCs such as Dyson, Samsung Electronics, Shein and Electrolux have either scaled down or shut down their Singapore operations. This is even as Amazon Web Services and pharma giant AstraZeneca have announced major investment commitments.

Speaking during the first day of debate on Budget 2025, Saktiandi asked if the government has done an in-depth study of the factors behind a company’s decision to reduce or completely remove its presence here.

He noted the “well-known and often repeated” points that Singapore needs to compete on value-add rather than cost, and that its attractiveness lies in its political stability and rule of law.

However, he wanted to know if there are mechanisms to study the particular factors that cause a company to “offshore” functions elsewhere.

“Think of it as an ‘exit interview’ for a departing employee,” he said. “We should take the chance to learn what didn’t go so well, what we can do better, and whether there will be further opportunities to collaborate again in the future.”

Attracting investments and good jobs is critical to Singapore’s survival, and it cannot be taken for granted that corporates will always choose to stay, he added.

Already, Singapore may see falls in the value-added per annum, job creation and total business expenditure arising from investment commitments, he said, citing the Singapore Economic Development Board’s (EDB) 2024 year-in-review report.

MNC-SME collaboration

Nominated MP Neil Parekh asked for an update on how many small and medium enterprises (SMEs) have benefited from the Partnerships for Capability Transformation scheme that fosters MNC-SME collaborations.

The government could provide more funding support or tax incentives to encourage deeper and longer term MNC-SME partnerships, driving greater industry transformation, he suggested.

Separately, Parekh noted that Budget 2025’s extension of the mergers and acquisitions (M&A) scheme demonstrates Singapore’s continued commitment to supporting business growth through M&As.

He offered two suggestions to strengthen this.

The first is for the government to set up dedicated advisory units, in partnership with trade associations and chambers. These can provide end-to-end support for SMEs pursuing M&As and joint ventures, as such companies may need help to navigate M&A complexities.

The second is for a legal framework facilitating cross-border corporate amalgamation, like the European Union, UK, and Delaware frameworks. This would leverage existing foreign demand for cross-border M&As, especially in the energy and technology sectors, he said.

“This should include establishing reciprocal agreements with key jurisdictions – particularly with Asean trading partners and developed financial hubs – to enable smoother deal execution,” he said.