…clashes with Patterson over Guyana’s infrastructure development

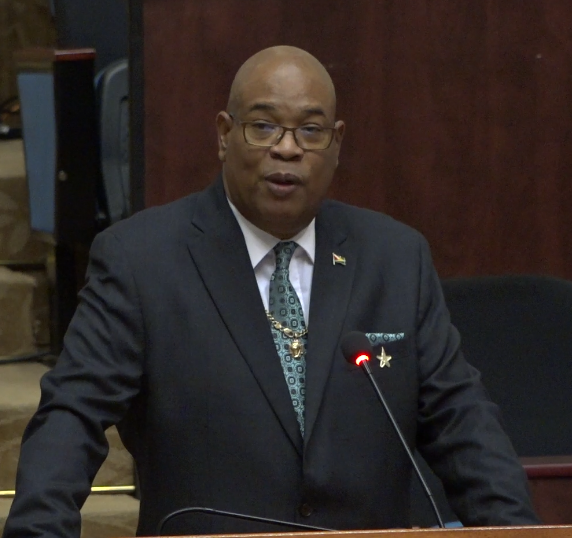

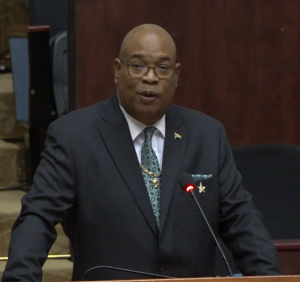

Public Works Minister Juan Edghill and his predecessor, David Patterson, on Wednesday faced off during the penultimate day of the budget debates, over the management of the Ministry and the current infrastructure development throughout the country.

The Public Works Ministry, which has traditionally gotten the lion’s share of the budget, was a focal point of Wednesday morning’s budget debates in the National Assembly. Edghill outlined the People’s Progressive Party/Civic (PPP/C’s) achievements in infrastructure development and noted that the only reason his predecessor, David Patterson, could not achieve the same results was a lack of vision.

“From 2020 to 2024, 4,322 kilometers of roads were constructed. From 2020 to 2024, 150 bridges were rehabilitated while 66 bridges were maintained. And these are not putting back wood bridges. These are putting in concrete bridges. From 2020 to 2024, 25,783 kilometers of sea and river defense structures were constructed, while 328,751 kilometers were maintained.”

“And the honorable member, Mr. Jordan from region five talked about a breach at Dantzig, that we came in and corrected. Ow, let us be fair with the people of Guyana. They do listen to we; they got sense. They could see for themselves. Since we’ve been in government, there has not been a breach at Dantzig,” the Minister outlined.

Edghill went on to point out that this was all achieved with the same Ministry of Public Works staff who once served under Patterson, many of whom were present in the gallery of the National Assembly for their Minister’s presentation.

“I would ask the honorable member Mr. Patterson, to take a look behind me. The same people he worked with, are the same people I’m working with. It had nothing to with the lack of competence of the staff.”

“It had nothing to do with the qualifications of the staff. The underperformance of the APNU/AFC was as a result of lack of policy direction, vision and capacity to implement vision,” Edghill further said.

While Patterson in his presentation was largely focused on criticizing the government’s development of energy sources like the Amaila Falls Hydropower Project (AFHP), he did also criticize the infrastructure development.

Interestingly enough, among the projects Patterson criticized was the Cheddi Jagan International Airport (CJIA) expansion. This is despite the CJIA expansion being a project the PPP/C had to renegotiate after it entered office in 2020, to ensure value for money.

“The East Bank and East Coast Road linkage… still incomplete. The Railway Embankment, Sheriff to Nassau, still incomplete. East Coast Road Belfield to Nassau, still incomplete. The Corentyne Highway, Palmyra, still incomplete. The Linden/Mabura road, four years and counting. Still incomplete. Soesdyke, Grove to Timerhi… CJIA, four years and counting. Still incomplete,” Patterson said.

The contract for the airport expansion project was initially signed in 2011 under the administration of former President Bharrat Jagdeo, with China Harbour and Engineering Corporation (CHEC).

The then People’s Progressive Party/Civic (PPP/C) Administration acquired a US$138 million loan from the China Exim Bank and used US$12 million from the Consolidated Fund (taxpayers’ money) for the total project cost of US$150 million.

However, upon assuming office in 2015, the project was downsized under the succeeding APNU/AFC administration. When they resumed office in 2020, the PPP/C Government reverted to the old proposal and negotiated a new agreement with the contractor that would have further expanded the airport.

In October 2024, the Government installed new e-gates at the CJIA, which will not only help to streamline the process for passengers traversing the facility but also enhance security checks to international standards.

Additionally, work is being done on the commercial centre at the CJIA. Avinash Contracting is also constructing the Administrative Building for the airport. Edghill had visited the site late last year and had warned the contractor that there will be no extensions or tolerance for further delays. The Minister had also met with all contractors undertaking various projects at the airport.

Read More Interesting Content